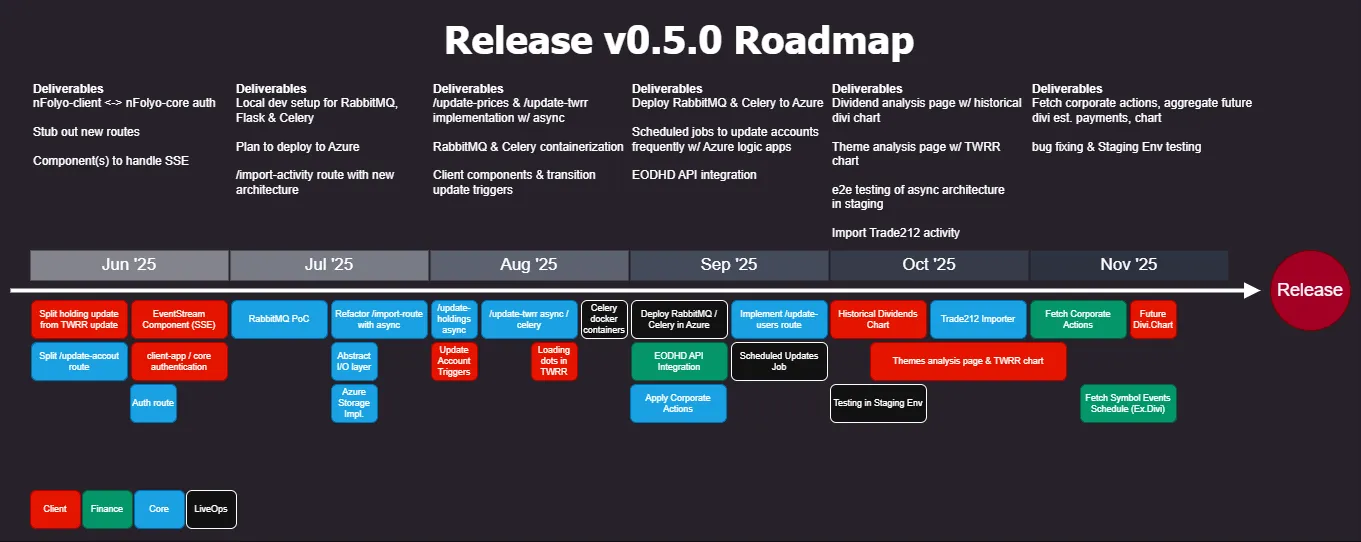

At nFolyo, we’re always pushing to make long-term investing smoother, clearer, and more insightful. With our upcoming v0.5.0 release, we’re taking some big steps: modernizing the backend, introducing new analytics, and integrating richer data to help investors make better decisions.

Our main goals for this release are:

- Refactor our services to use Celery workers for heavy tasks and Server-Sent Events (SSE) for live status updates.

- Introduce charts to visualize historical and future estimated dividend income.

- Add support for Trade212 as a broker, making it easier to import your activity and keep your portfolio up to date.

Here’s a behind-the-scenes look at what’s planned, why it matters, and what it means for you.

Modernizing the Core (June – July ‘25)

We’re starting by strengthening the foundation, as discussed in our nFolyo Post-MVP - Architecture and Tech Stack Review:

- Adding secure authentication between nFolyo-client (frontend) and nFolyo-core (data processing backend).

- Introducing Server-Sent Events (SSE) for faster and more reliable portfolio updates.

- Refactor the

/import-activityroute to use Flask, Celery, RabbitMQ and SSE events for updates between nFolyo-core and nFolyo-client, as proof of concept for the new architecture.

These upgrades prepare us for faster data processing and a smoother experience.

Moving to Async & Containers (August ‘25)

Next, we’re overhauling how data flows inside nFolyo:

- Migrating account, holdings, and TWRR update routes to an async architecture powered by Celery workers.

- Building client-side components to handle these updates seamlessly.

- Containerizing RabbitMQ and Celery to deploy them efficiently on the cloud.

This means quicker updates to your portfolio, better reliability, and reduced latency.

Deploying to Azure & Integrating New Pricing Provider (September ‘25)

In September, we’re deploying our services on the cloud for extensive testing before going live. We’re also integrating EODHD API for more reliable price data.

- Deploying RabbitMQ & Celery to Azure for scalability and resilience.

- Setting up scheduled jobs to keep your portfolio data fresh using Azure logic apps.

- Integrating the EODHD API, unlocking access to better financial data.

- Supporting corporate action adjustments to keep your holdings accurate.

These integrations ensure your data is timely, accurate, and enriched with deeper insights.

New Analytics & Visuals (October ‘25)

We know numbers matter—but so does how you see them:

- Introducing a dividend analysis component with a historical dividends chart.

- Launching a theme analysis page with theme specific stats and TWRR charts to visualize performance.

- Adding support to import activity from Trade212, a popular broke in EU and the UK.

- Running extensive end-to-end tests of the new async backend in staging.

The goal? Helping you see the bigger picture of your portfolio’s performance and strategy.

Final Touches & Future Data (November ‘25)

As we approach release:

- Integrating APIs to fetch corporate actions (as some brokers don’t provide those in their activity statements) and future dividend events.

- Introducing a future dividend chart so you can track upcoming income.

- Fetching symbol event schedules (like ex-dividend dates) for even more context.

- Final bug fixes and more staging environment testing.

These finishing touches will help you plan ahead and stay informed.

Looking Ahead

v0.5.0 is all about scaling, speed, and smarter insights:

- Moving to async architecture with Celery and more reliable updates via SSE.

- Deploying fully on Azure for reliability and scalability.

- Enriching your portfolio data with external APIs and deeper analysis tools.

- Supporting new brokers like Trade212 to make tracking your investments even easier.

We’re excited about what’s coming, and even more excited to see how it helps you make confident, data-driven investing decisions.

Stay tuned!